Published

Share

While InterGlobe Aviation Limited (NSE:INDIGO) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 11% in the last quarter. On the other hand the share price is higher than it was three years ago. In that time, it is up 76%, which isn't bad, but not amazing either.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

See our latest analysis for InterGlobe Aviation

SWOT Analysis for InterGlobe Aviation

- No major strengths identified for INDIGO.

- Interest payments on debt are not well covered.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio and estimated fair value.

- Debt is not well covered by operating cash flow.

- Total liabilities exceed total assets, which raises the risk of financial distress.

Because InterGlobe Aviation made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last 3 years InterGlobe Aviation saw its revenue grow at 14% per year. That's a very respectable growth rate. The stock is up 21% per year over three years, which isn't bad, but is nothing to write home about. Arguably, that means, the market (previously) expected stronger growth from the company. However, if you can reasonably expect profits in the next few years, this stock might belong on your watchlist.

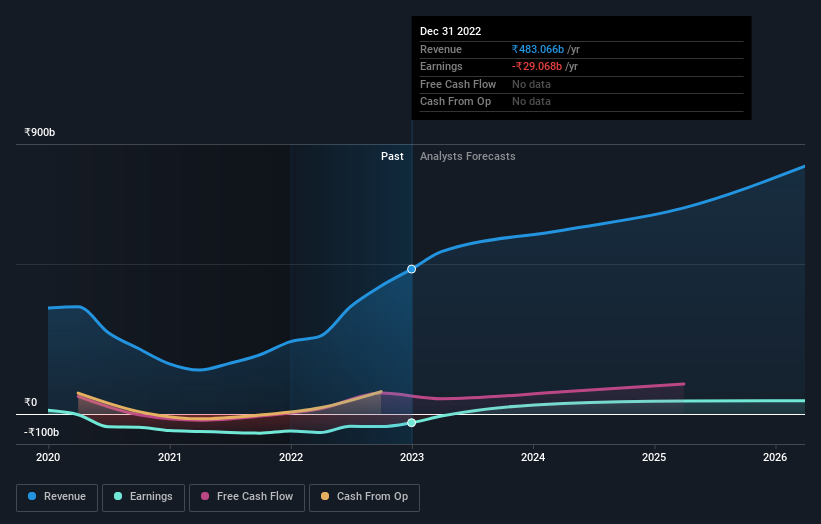

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

InterGlobe Aviation is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling InterGlobe Aviation stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Although it hurts that InterGlobe Aviation returned a loss of 1.0% in the last twelve months, the broader market was actually worse, returning a loss of 2.8%. Of course, the long term returns are far more important and the good news is that over five years, the stock has returned 5% for each year. It could be that the business is just facing some short term problems, but shareholders should keep a close eye on the fundamentals. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with InterGlobe Aviation , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

No comments:

Post a Comment